ONE-YEAR PREMIUM VISA

The One-Year Premium Visa is a new visa being issued by Mauritius since the end of 2020 to encourage foreign nationals to come for a long stay as a tourist, retiree or a professional willing to come with his/her family and carry out his business or work remotely from Mauritius, in a COVID-safe destination.

It allows a non-citizen to stay in Mauritius for a period of one year, renewable.

The FATF Plenary Session 21-23 October and the Status of Mauritius

The FATF Plenary Session 21-23 October and the Status of Mauritiusby Kaminee Busawah31 March 2022The 3rd Financial Action Task Force Plenary Session which took place from the 21st to 23rd October 2020 discussed the following agenda: Strategic Initiatives ML/TF Risks and FATF Policy Responses to COVID-19 since May 2020 Strengthening the Global Network Country-specific processes Impact of COVID-19 on FATF … Read More

Master Class on AML/CFT for Designated Non-Financial Business and Professions “DNFBP”

In view of the development of the legislative frameworks to combat Money Laundering and Terrorist fiancing, Money Laundering resorted to DNFBPs (Designated Non- Financial Business Professionals) to try to conceal laundered proceeds and revenue of crimes.

MLRO and AML/CFT Compliance Support Services

HLB MAURITIUS focuses in providing MLRO & AML/CFT Compliance support services to its customers. We provide customized solutions to suit our clients’ obligations as required by the FIAMLA ACT 2002 and the local Regulators. Our main objective is to ensure that our customers are fully compliant with the local & international obligations by applying the risk-based approach and on-going monitoring.

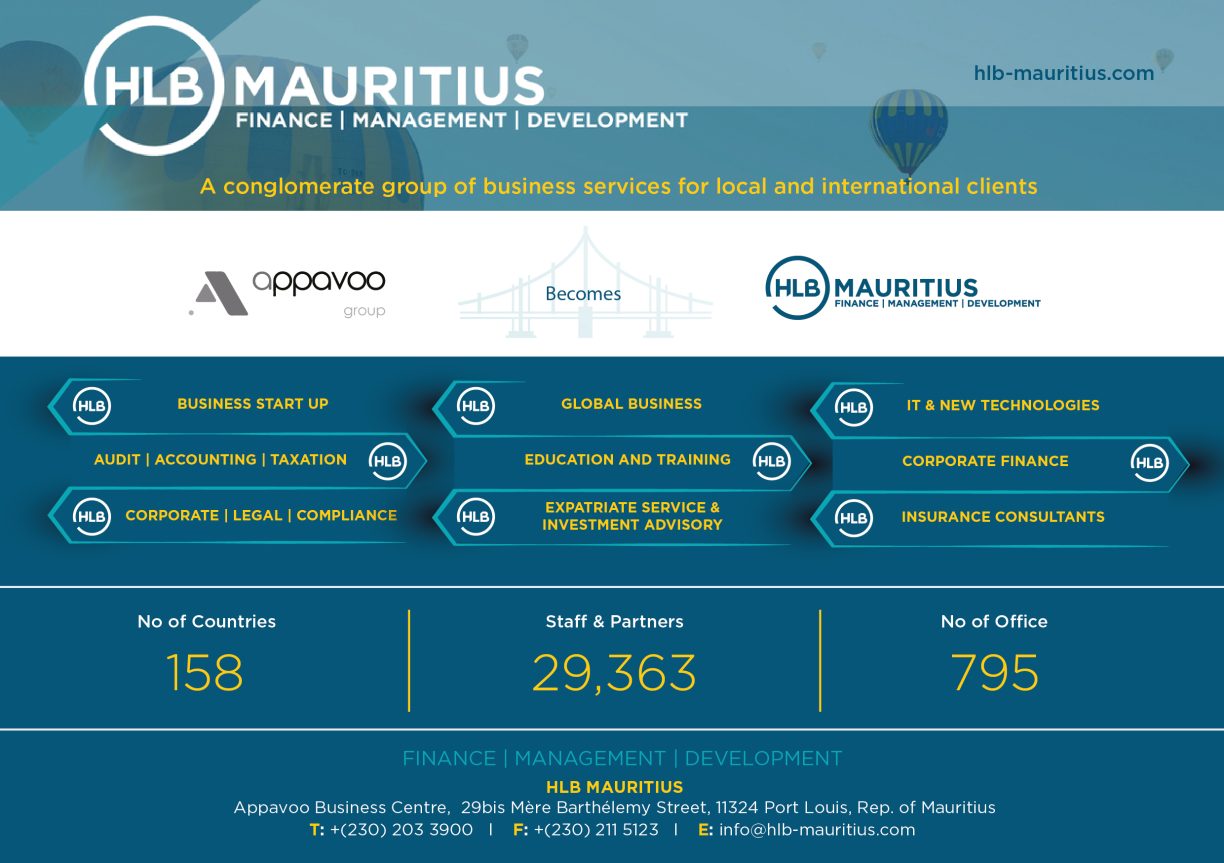

An International platform to serve clients differently!

The pandemic has changed the paradigm of Competitive Advantage. Operational agility, lean supply chains, deep understanding of customer demand, a high level of remote and digital readiness are now the key factors of success. More than a re-branding exercise, Appavoo Group becomes HLB MAURITIUS to re-invent business with a real paradigm shift and to serve clients better.

Banking Courses

HLB MAURITIUS (Education and Training) led by Appavoo Business School, a Registered Training Institution is pleased to introduce a series of practical courses on Banking, led by Mr Mario Hennequin, an experienced Banking Expert.

An insight in Voluntary Administration

Voluntary Administration is a term actually making the headlines in our local press and on the international scene also following the economic downturn caused by the COVID pandemic.

Budget Highlight 2020

HLB Mauritius is pleased to share its comments on the budget speech 2020 which was delivered by Minister of Finance on Thursday 4 June 2020.

WORKER’S RIGHT ACT 2019

Getting a grip with Worker’s Right Act 2019: HLB Mauritius brings light to the various intricacies of the employment law in the aftermath of COVID 19.